Web 3: Business Models for a Sustainable Decentralized Internet

A dive into web 3.0 monetization and sustainability

In recent years, we’ve seen a rise in Decentralized applications and an extension of Blockchain use cases outside of decentralized finance. This increasing demand, as well as the impending surge of these use cases, has prompted several questions, including:

“What new business model will determine a sustainable future for a decentralized business?”

This article discusses Web 3.0 business strategies, how they work, and how they vary from prior Web 2.0 ideas. With over a $2 trillion market cap, let us explore a few established and experimental Web 3.0 business models used by top Web 3.0 organizations worldwide and see where your business can best fit in. Here’s a rundown of some of the models we’ll be looking at:

- Transaction fee

- Issue native token

- Subscriptions

- Advertisement

Transaction fee

The transaction fee model is the most frequent and efficient revenue model in the decentralized application ecosystem. Transaction fees are not foreign to us, coming from the web 2.0 and traditional finance sector. Depending on what type of product you are building, you can choose from these transaction fee strategies:

- Charge on Volume: A clear example of this would be Uniswap v2 which charges a 0.3% transaction fee on any Volume swapped on the exchange. This model works best for Exchanges and Marketplaces.

“Uniswap v3 introduces multiple pools for each token pair, each with a different swapping fee. Liquidity providers may initially create pools at three fee levels: 0.05%, 0.30%, and 1%. More fee levels may be added by UNI governance, e.g. the 0.01% fee level added … governance proposal in November 2021” — Uniswap fees.

Third-party integrations: When developing decentralized apps, integrating third-party solutions rather than starting from scratch is becoming more frequent. An example is using the 1Inch API to implement token swaps without worrying about complex concerns like providing liquidity.

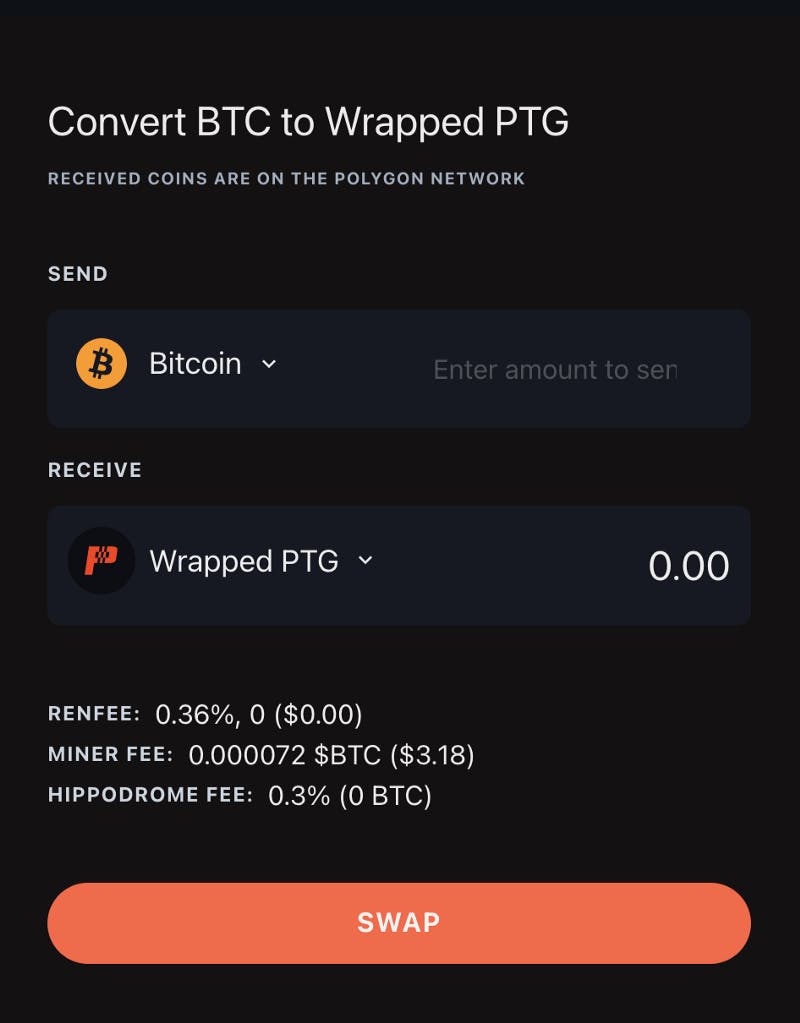

1inch allows you to set an additional transaction fee for users on your platform. An example of this is how Hippodrome charges a 0.3% fee on Ren and 1inch charges when users perform cross-chain asset exchange.

Another product currently using this model is LazerPay; although still very early, they have made significant progress in integrating this into their product. They are also exploring and researching a subscription payment model, which we will dive into in the next section.

Hippodrome swap action — hippodrome

- Network fee: Network fees are the most common amongst blockchain networks such as Bitcoin, Ethereum, Solana, etc. These charges are usually unavoidable as they are required to process transactions sent to the network. This is done to reward participants such as miners in a Proof-of-Work model who partake in verifying actions on the decentralized web. Considering the nature of a decentralized business, finding a viable model to best reward the community for participating in-network activities can significantly increase the business’s success.

- Sale action fee This model involves taking a percentage of a buy/sell action made on the platform. An excellent example of this model is how Open Sea charges a 2.5% fee on sales in the marketplace. Although Open Sea is not decentralized, a decentralized marketplace might use its economic model to provide a long-term means of compensating the community.

With its play-to-earn approach, the decentralized game industry is another business that has made significant progress in integrating an action-based approach to charging users.

The difference between a Web 2.0 and a Web 3.0 transaction fee model is the end receiver of the transactions fees. Network fees on most blockchain networks go to miners, most of which are not centralized entities. Transaction fees on Uniswap exchanges and other decentralized exchanges go to liquidity providers incentivized to provide liquidity for a smooth transaction process on the platform.

Issue Native Token

Issuing a native token model has shown efficient results in maintaining a healthy community and a successful decentralized business. Bitcoin pioneered this model with its Proof-of-work mechanism in 2009. Considering Bitcoin’s decentralized nature, developing a paradigm that would best motivate network participants was necessary. Incentivising network validators using Bitcoin added extra layers of security for users of the network while still maintaining a completely decentralized and trustless system.

In the Web 3.0 ecosystem, this strategy to reward the community has been successful. Other significant participants, including Ethereum, Solana, and BSC, have offered Native tokens to encourage healthy network participation.

Let us look beyond core network tokens. Decentralized Autonomous Organisations (DAOs) issue native tokens to grant voting rights to the community and reward good participants. At the core of a decentralized business is the community; maintaining a proper reward system that can drive diverse participation will lead to the business’s success.

Audius and Minds are examples of using a native token to drive platform participation. Audius’ primary value and revenue generation are explained in the following Twitter discussion.

With the rise of the token sale, a new wave of blockchain initiatives predicated their business models on payment tokens within networks, often forming two-sided marketplaces and requiring the usage of a native token for all payments. According to the assumptions, as the network’s economy grows, demand for the restricted native payment token grows, resulting in a rise in the token’s value.

While the value accrual of such a token paradigm is debatable, the extra friction for the customer is apparent. While this paradigm was popular during the 2017 token fever, its friction-inducing properties have pushed it to the back of the development queue in the three years.

We’ve gone over some of the most frequent and effective models employed by top decentralized organizations; now, let’s look at some experimental strategies that have seen significant research and implementation success.

Subscriptions

Benefits of subscriptions for decentralized Apps — 1337 Alliance

The subscription model has proven to be a successful means of providing service to an extensive range of customers and maintaining a constant revenue stream for businesses. There is no sign of slowing down; with over 50% of software revenue streams coming from a subscription model in 2021, it has proven to be a modern, sustainable and scalable revenue stream for legacy applications.

With more businesses moving to the Blockchain, the need to integrate a subscription model in decentralized applications is becoming immense. Although still experimental, there have been some breakthroughs in research and implementation. In 2018, this Github thread presented the structure for a subscription model on the Ethereum blockchain, which led to the EIP-948 token standard for recurring payment on the Ethereum protocol.

The economic benefit of a token standard that promotes financial facts from the previous decade establishes the subscription economy. However, why a completely new protocol is considered arises. Check out this Consensys guide to dive deeper into understanding subscription services on the Blockchain.

Although there are still significant challenges right now, one of significance is the need for users to sign every transaction with a private key. Let us look at recent experimental implementations of a subscription model on the Blockchain over the past three years:

- Groundhog is a set of tools powering the integration of crypto subscriptions in decentralized applications. The state of these tools are currently experimental, but progress has been made over the year.

- Crypto.com announced in September 2021 that they had launched a feature to allow merchants to collect recurring payments through the platform. Although crypto.com isn’t a fully decentralized business, the implementation shows that more companies are looking into an efficient decentralized subscription model.

- AmbrPay promises a decentralized payment solution using the Ethereum blockchain. Again not a fully decentralized business; they have made significant progress in implementing recurring payments using Ethereum.

Businesses that can take advantage of this model are media streaming, payment solutions, and most B2C solutions.

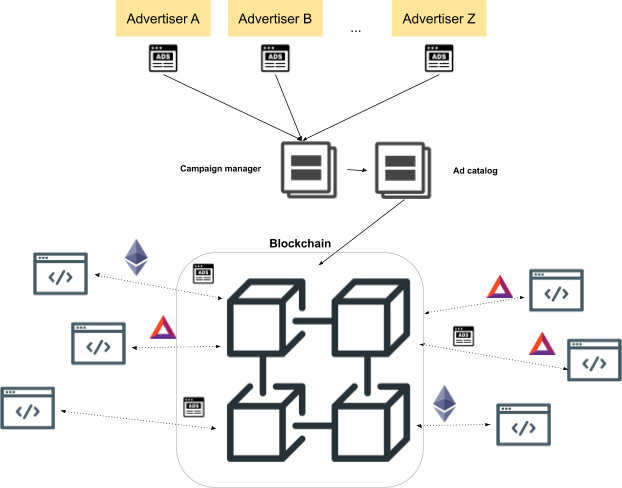

Advertisement

Currently used by the biggest technology companies and even newer players, the Advertisement business model has been an integral part of revenue streams for most businesses succeeding on the internet.

With the continuous rise of advertisement needs by most online companies, the need to have a more personalized ad experience delivered to users has been the focus for more service providers. To successfully show quality personalized ads, companies need access to in-depth data on users of their services. Over the years, these have raised more ethical questions surrounding their approach to collecting data.

It is possible to limit the amount of data that these services have access to for the most part. Even though there is a lot of revenue generated for these services by having access to users’ data, there is rarely any monetary value delivered to customers with the existing paradigm.

With a decentralized advertisement model, the revenue generated from selling personal information can be shared with service users.

An example of a successful decentralized advertisement model is Brave’s reward system using its BAT token.

“The BAT token powers the BAT-based advertising ecosystem. The main goal of the BAT-based ad ecosystem is to provide the choice for users to value their attention, while keeping full control over their data and personal privacy. The main tenets of the BAT-based advertising ecosystem are to provide privacy by default, to restore control to users over their data, and to provide a decentralized marketplace where Brave Browser users are incentivized to watch ads and to contribute to creators. Through these principles, Brave’s vision is to fix the current online advertising industry, and get rid of widespread fraud schemes, market fragmentation and privacy issues.” — Brave

Advertisement in Web 3.0, which aims to give more control to users, is still relatively new and still seeing rapid development and implementation. We will see more decentralized businesses move towards this model in the coming years.

Photo credit: Brave Rewards

Final thoughts

Looking back, we can see that Web 1.0 and Web 2.0 required a lot of trial and error to develop the suitable business models that resulted in today’s tech titans. We’re not ignoring the fact that Web 3.0 will have to go through a similar iterative process. Still, once we find suitable business models, they’ll be compelling. In trust-free environments, individuals and businesses will be able to interact on a whole new level without relying on rent-seeking intermediaries.

At the core base of a decentralized business is a healthy community. Constantly evolving to maintain beneficial participation by the community will lead to success and wide adoption of any service offered.

As a decentralized business founder, consider experimenting with some of these Web 3.0 business models and see what works best for you and your target community.

For further reading, do check:

- FEM Business Model — “Web3 revenue primitives https://github.com/FEMBusinessModelsRing/web3_revenue_primitives”

- Max Mersch’s “Which New Business Models Will Be Unleashed By Web 3.0?”

Photo credit: Haze Monkey NFT